Understanding Iowa Property Taxes Paid in Arrears (and How to Calculate Your Proration)

If you're selling a home in Iowa, one of the biggest surprises on your settlement statement is the property tax proration—the amount you credit the buyer for taxes that have accrued but are not yet due. Nearly every seller asks the same question:

“Why do I owe 9–14 months of taxes if I’ve always paid my bills on time?”

The confusion makes sense, because Iowa handles property taxes differently than many other states.

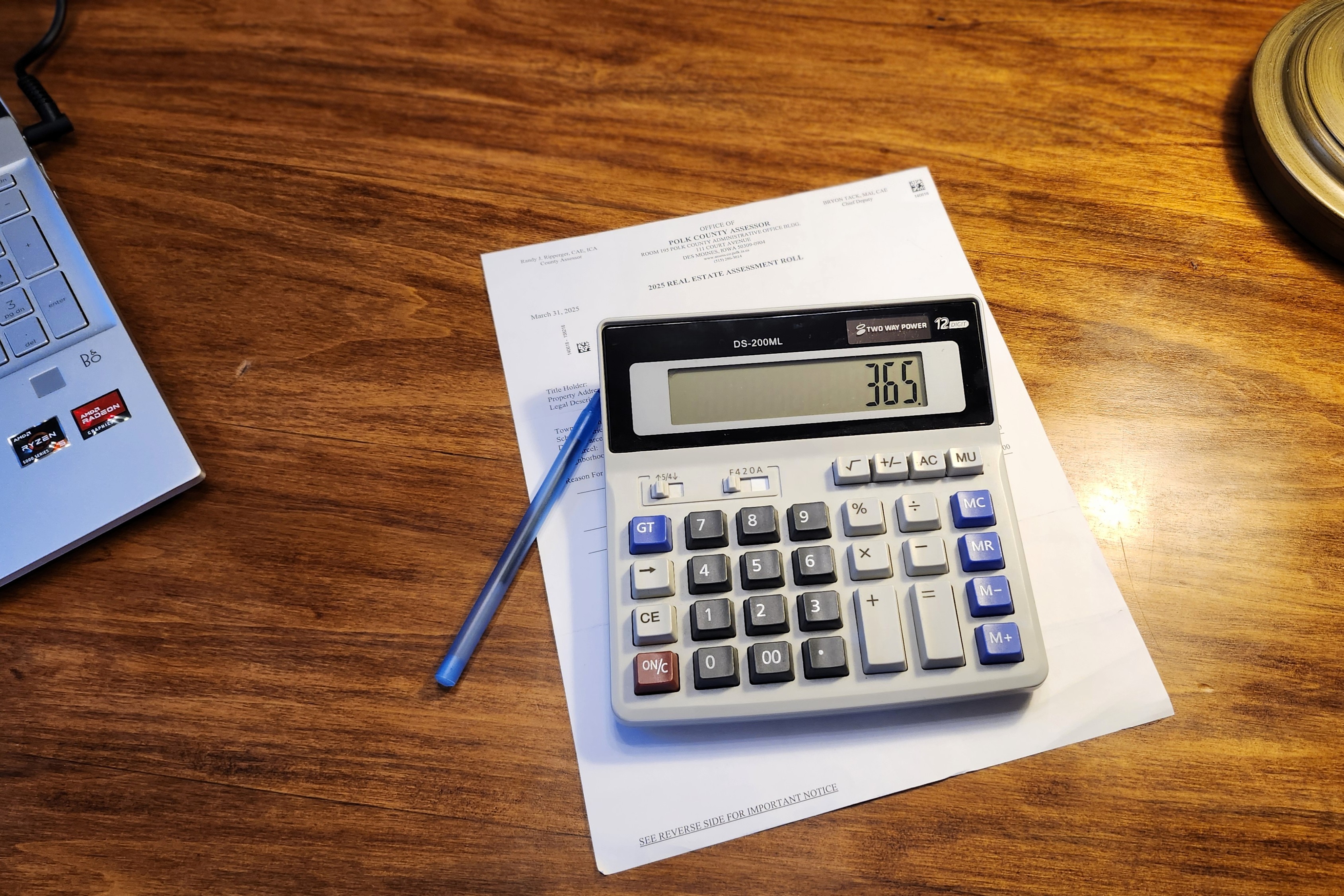

This page includes a built-in Iowa Property Tax Proration Calculator, allowing sellers and buyers to instantly estimate:

Months and days of property taxes owed

Per-diem amounts

Expected credits

The impact of closing date changes

Because the calculation is so important—and sometimes confusing—this tool gives you clarity before you list your home.

Iowa Property Taxes Are Paid in Arrears

This is the key concept:

Iowa property taxes are always paid for the previous year, not the current one.

Two Payments Each Year

September 1 – first half becomes payable

Interest starts after September 30March 1 – second half becomes payable

Interest starts after March 31

But both of these payments cover a tax period that has already ended.

For example:

Taxes payable Sept 1, 2025 and

Taxes payable March 1, 2026

…both cover the 2024–2025 tax year (July 1, 2024 – June 30, 2025).

So when you pay a bill, you're paying last year’s taxes—not the months you're currently living in the home.

Why Sellers Owe 9–14 Months of Taxes at Closing

Because taxes are paid in arrears, sellers always owe for part of the current cycle.

When you sell your home, the buyer receives a credit for the months you lived in the property but haven’t yet paid taxes for.

The amount is usually between 9 and 14 months, depending on when you close.

What affects the amount?

Closing far after a tax payment date = more accrued months

Closing right before a payment due date = fewer accrued months

Proration cycles reset twice per year based on when taxes are considered paid:

September 30th and March 31st

Common Questions From Iowa Sellers

Do I need to bring money to closing?

No. The property tax credit is automatically deducted from your sale proceeds.

What if I just paid my tax bill?

Great—your paid-through date is accounted for.

The prorated amount simply begins after the period you’ve already covered.

What if the closing date changes?

The proration changes, too.

Your closing statement includes a daily rate, so the amount adjusts automatically.

Didn’t I already pay these taxes?

Most sellers believe they’re current, but that’s only because Iowa bills are delayed.

You likely received a tax credit when you bought the home.

Now you’re giving one to your buyer—it’s the same cycle continuing.

How PROmetro Realty Helps You Understand These Numbers

Every PROmetro Realty listing plan—Starter, PRO, and Premier—includes a detailed Estimate of Proceeds, outlining:

Every PROmetro Realty listing plan—Starter, PRO, and Premier—includes a detailed Estimate of Proceeds, outlining:

Expected sale price

Loan payoff

Closing and title costs

Your property tax proration estimate

Since the tax proration is often one of the largest items on a seller’s statement, we make sure you understand it long before closing day.

Don’t Forget: Apply for the Iowa Homestead Tax Credit

If you're buying a home, there’s a valuable tax benefit waiting for you.

What is the Homestead Credit?

A long-standing Iowa program that reduces your yearly property taxes on your primary residence.

Why sign up?

Lowers your property tax bill

Reduces your mortgage escrow payment

You only apply once (unless you move)

Who qualifies?

Any Iowa homeowner who occupies the property as their primary residence and files the application with their county assessor.

Many buyers forget to apply—and leave money on the table.

Other Iowa Property Tax Exemptions You May Qualify For

Iowa also offers valuable exemptions for certain homeowners:

Military Service Property Tax Exemption

For eligible veterans and service members.

Reduces the taxable value of the property, resulting in lower taxes.

65+ Property Tax Exemption

An exemption for Iowa homeowners aged 65 and older.

Reduces assessed value and lowers annual taxes.

Important

Each exemption has its own eligibility rules and application process.

More information is available through the Iowa Department of Revenue and your county assessor.

Final Thoughts

Iowa’s system of paying property taxes in arrears often causes confusion, but once you understand what period each payment covers, the proration at closing becomes clear.

You received a credit when you bought your home.

Your buyer will receive a credit when they sell.

It’s simply how Iowa’s tax cycle works.

At PROmetro Realty, we ensure every seller understands these numbers—long before closing—so you can plan confidently, avoid surprises, and make informed decisions.

And with our built-in Iowa Property Tax Proration Calculator, you can estimate your numbers instantly.